Most business owners never find the financial freedom they set out to achieve.

...unexpected tax bills

...stressing about cash flow

...no reliable forecast or plan

Learn proactive financial and tax strategies that help you build massive wealth as an entrepreneur.

YES! SHOW ME HOW!

YOU'VE SET GOALS.

YOU'VE PUT YOUR HEART & SOUL INTO YOUR BUSINESS.

What happens when YOUR BUSINESS SUDDENLY TAKES OFF and you MAKE MORE MONEY THAN YOU DREAMED POSSIBLE?

That's supposed to be a good thing!

BUT...

IF YOU'RE ANYTHING LIKE THE ENTREPRENEURS I HAVE WORKED WITH, THEN YOU'VE PROBABLY REALIZED THAT GETTING BLINDSIDED BY A SURPRISE TAX BILL UPWARDS OF $10,000 COULD LEAVE YOU SCRAMBLING TO SAVE YOUR BUSINESS...

...AND MAY EVEN PUSH YOU TO GIVE IT ALL UP.

HAVE YOU FOUND YOURSELF...

▶︎ Feeling like you don't know what you don't know, and have a sneaking suspicion that you aren't taking advantage of legal loopholes you could be using?

▶︎ Stressing about your next tax bill because you've made good money this year and you have no idea how much needs to be set aside for tax, or what you can do to legally lower what you may owe?

▶︎ Having to pay more in taxes just to show enough income for a mortgage or other loan?

▶︎ Unable to get any helpful answers from your CPA or tax preparer? Why do they make you feel like you’re bothering them any time you ask a question?

▶︎ OVERPAYING TAXES by $5,000 TO $15,000 every year without knowing what went wrong?

A Quick Introduction.

I'm Brian Basinger.

For the last 10 years, I’ve been helping wealthy clients at a top CPA firm pay as little on their tax returns as possible.

And I've also been called in to help countless new entrepreneurs and small business owners who faced some major tax problems.

The contrast was eye-opening.

I realized that new entrepreneurs are often stuck between a rock and a hard place. They can’t afford tens of thousands for an expert, but they also can’t afford the risks of a budget CPA.

Even so, most new entrepreneurs will choose the budget CPA, hoping that they aren't overpaying, and praying that their freshly filed tax return isn't waving a huge sign that says audit me.

That's why I started Contigo Advisors.

I wanted to help small business owners and entrepreneurs like you take advantage of the same tax loopholes that the top entrepreneurs have already figured out.

In my career, I’ve seen countless tax returns prepared by budget CPAs that will probably trigger an audit and require their client to pay thousands more in taxes than they’re supposed to.

My goal is to drastically lower your risk of an audit and help you never pay a penny more than you should to the IRS. (Because the IRS won't make the corrections for you and give you back any money that you overpaid).

It's actually easier than you think.

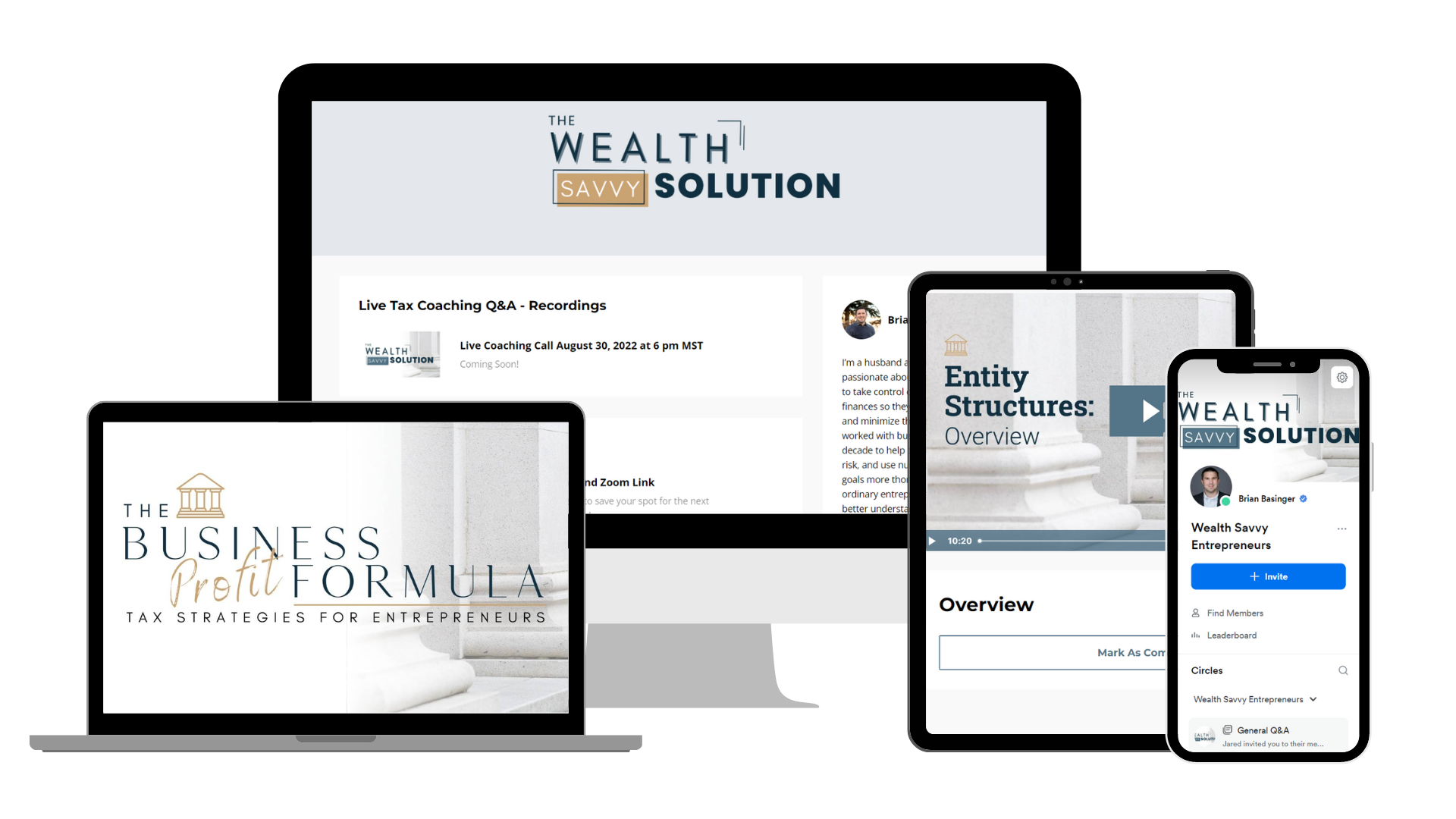

THE WEALTH SAVVY SOLUTION:

TAX PLANNING CHALLENGE

Tax Strategies for Entrepreneurs

In The Wealth Savvy Solution: Tax planning Challenge, I share simple tax strategies to help you save money, avoid getting blindsided by an unexpected tax bill, and how to drastically reduce your chances of ever being audited.

- Learn how to correctly set up your business. Should you be a sole-proprietor, LLC or S-Corp?

- Avoid all the small business red flags that trigger an IRS audit. (Most small business owners usually have at least one on their last tax return).

- Find out if it's possible to deduct your mortgage payment from your business income.

- Get wealth-building tips to protect your retirement funds.

- Learn some new tactics like income shifting. (Have you ever wondered why some entrepreneurs "hire" their kids as part of the business?)

- Maximize your tax savings with assets that can be depreciated.

- Learn exactly what can be a deduction and what can't.

00

DAYS

00

HOURS

00

MINS

00

SECS

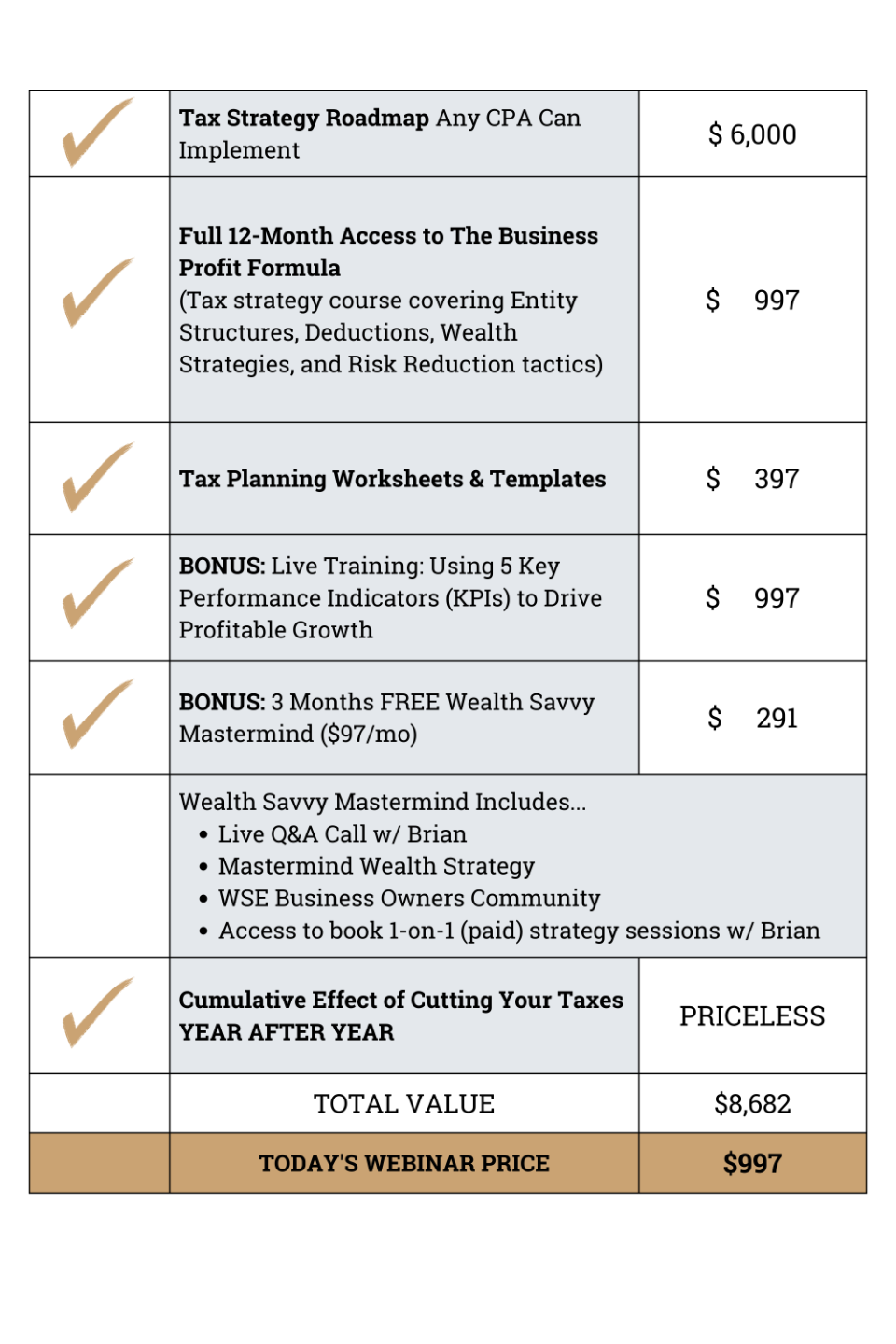

WHAT YOU GET WHEN YOU ENROLL IN THE SPECIAL WEBINAR OFFER

(Expires Friday, March 5, 2023)

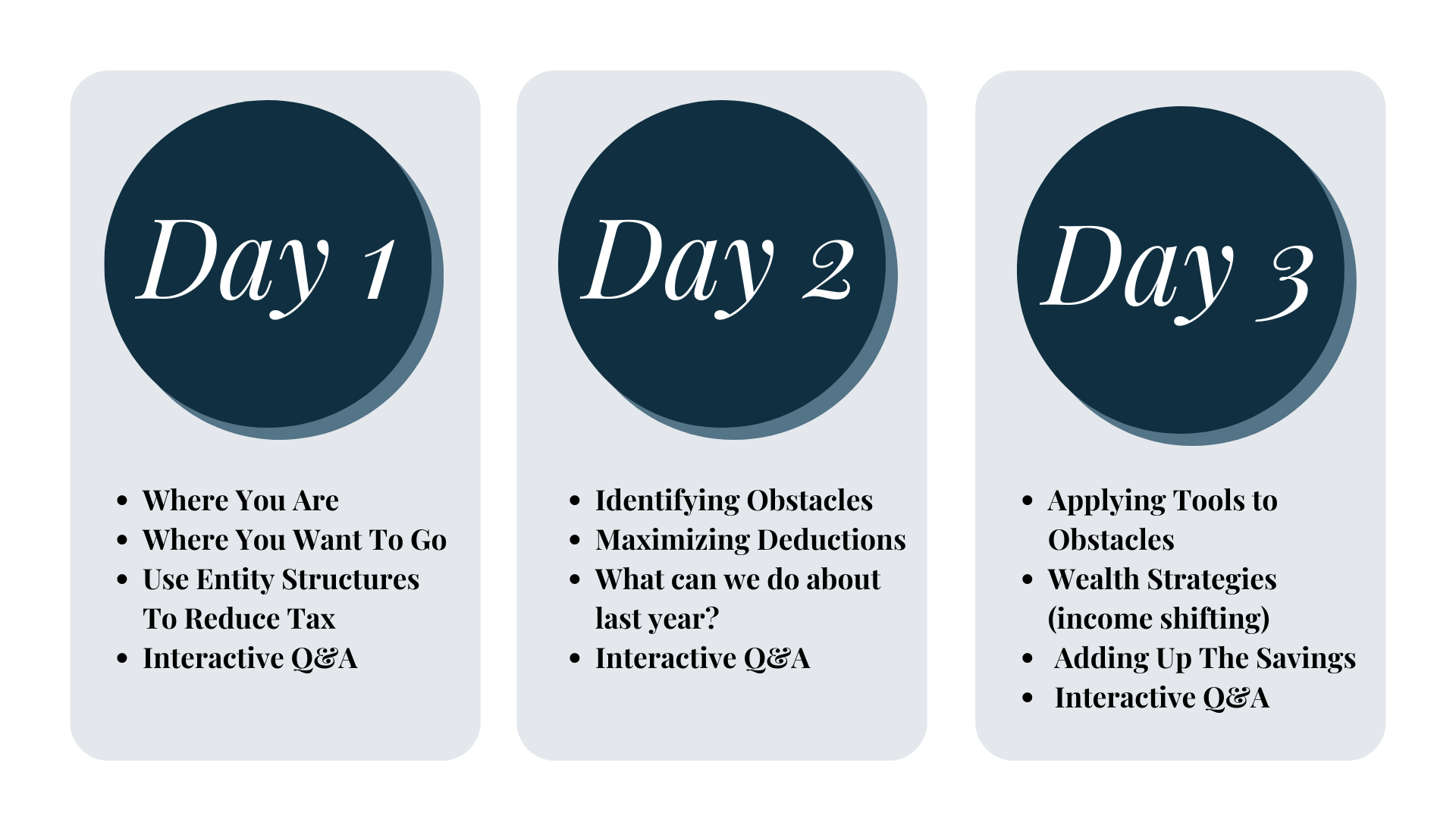

Our Live, 3-Day Tax Planning Challenge

Access to Our Suite of Tax Support & Strategy Products

Chase Williams

With Brian's help and guidance, I lowered my taxes by 40% last year, and this year - with more time to plan - I'm on track to cut my tax bill by almost 80%!!! I have attended other financial seminars and read other financial books and systems, but the guidance I've received from Brian has been the most impactful because it is easy to understand and put into action.

Aaron Skinner

I've been following Brian's system for 7 years. I use the strategies he teaches to make sure the money I earn is part of a proactive plan so I have money to invest and so I can enjoy life without wasting time worrying about money.

Alex Rossman

I've always had financial goals, but never had a specific PLAN before working with the Wealth Savvy Mastermind. I followed Brian's guidance on how to set up my entity structures to lower my taxes, started holding monthly financial reviews with my management team, and within our first two months we were able to increase our profit margin by over 30 percent! Now that I'm using my key numbers every week to spot and fix problems right away, I am able to control my agency and make sure we hit our goals every month and year.

IF YOU'RE TRYING TO JUST "FIGURE IT OUT ON YOUR OWN"

(as many entrepreneurs attempt to do)

BE HONEST. ARE YOU...

Using tax tips from Google searches, YouTube videos, or something your brother-in-law told you?

Trying out a new CPA every year?

Buying crap you don't need - just to take a tax deduction?

Running personal expenses (meals, Amazon orders, clothes, groceries, haircuts, gym membership) through your business accounts, hoping you can sneak them in as deductions?

Putting money into an IRA when you would have preferred to invest the money in your business?

Setting aside money to pay for taxes with no idea if it is too much or too little?

DO YOU REALLY WANT TO TAKE THESE KINDS OF RISKS WITH SOMETHING YOU HAVE BUILT FROM THE GROUND UP?

So, the question now is...

Would you rather put all of your trust in a small-time CPA (who has no interest in you or your business other than to fill in the blanks of your return) just to pay less for their services...

...Or would you rather be your own best advocate and have the inside information that can save you money and reduce the risk of an IRS audit?

Because, when you have this information, you can keep better records, strategize expenses, and KNOW THE RIGHT QUESTIONS TO ASK when (and if) you decide to hire a CPA to file your return.

When you enroll, you will have immediate access to all the modules in the course so that you can start implementing what you learn for your business TODAY.

By the way, there is NO RISK in enrolling today.

If you decide that The Wealth Savvy Solution isn't for you, no worries! You can contact us within 10 days of your purchase to request a refund and we will give you your money back. We offer this refund because it's fair and simple to understand. If you contact us more than 10 days after your purchase, we do not offer refunds.

You can start putting these tax strategies to work today.

This is the perfect opportunity to make sure that you are taking advantage of all the tax breaks and deductions that could end up putting money back in your pocket.